Building a new money-confident generation

A classroom-ready solution that weaves money skills into the curriculum

What's Inside

Hundreds of ready-made resources, 3 core programmes

MoneySmarts®

Ages 4 - 11

Core financial literacy for primary pupils

The essential financial education programme for Reception to Y6.

Everything from what money is to compound interest. MoneySmarts fully covers Young Enterprises's 4-11 Financial Education frameworks, and has been awarded the prestigious financial Education Quality Mark.

Topics include:

- What money is and how people use it

- How money is earned through work and effort

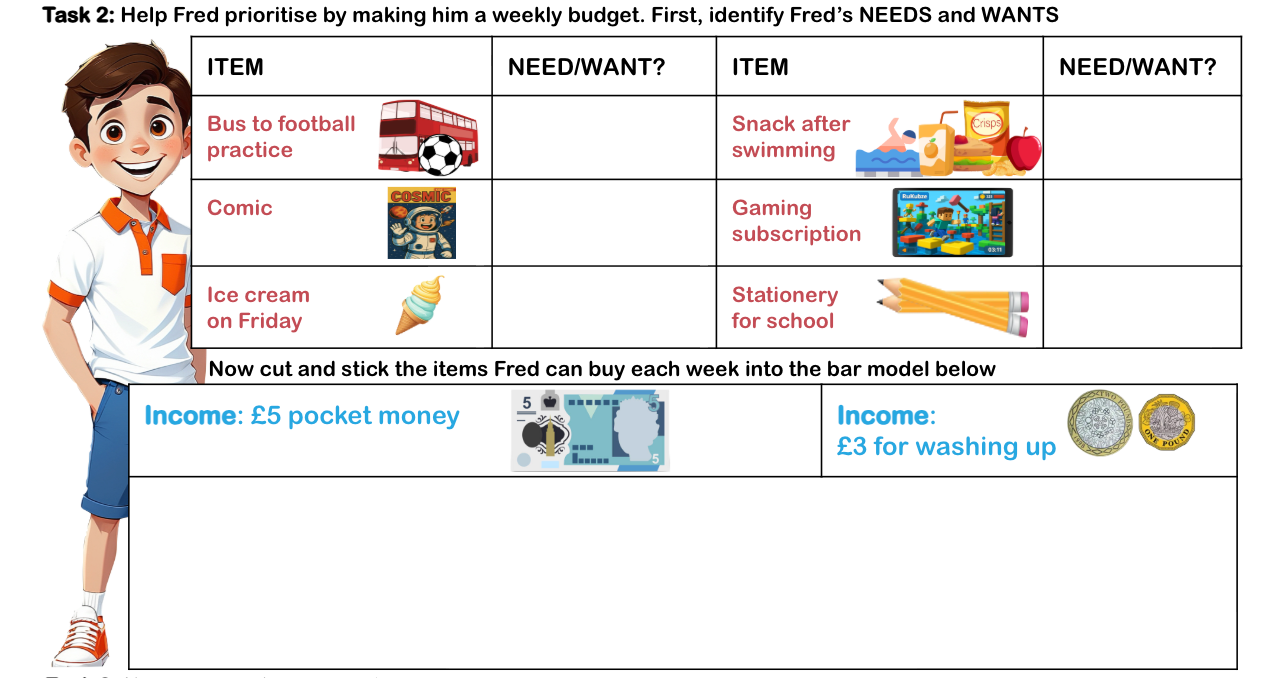

- How to choose between needs and wants

- How and why people save money

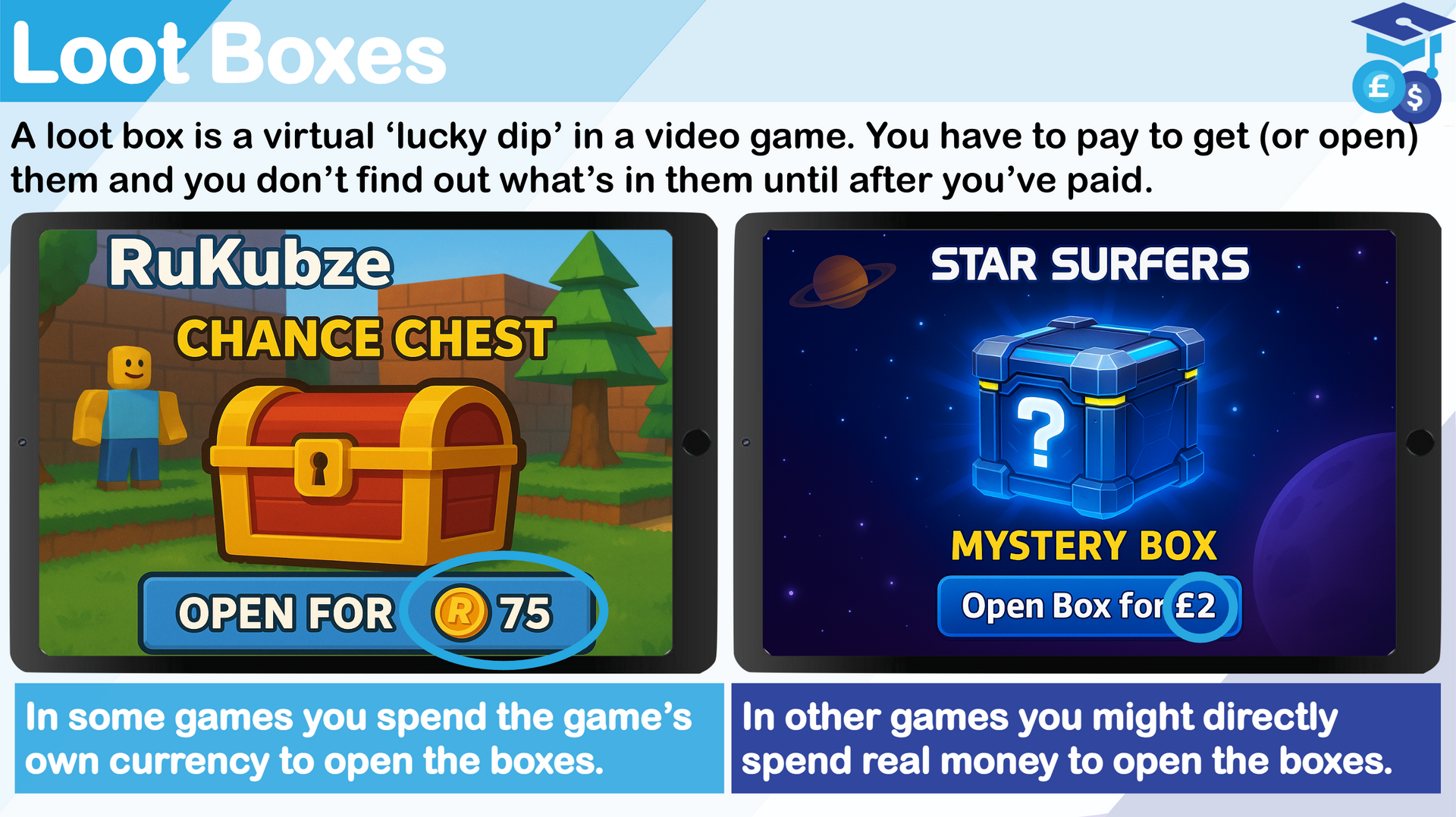

- How to track money using simple budgets v Spottina scams and online money risks

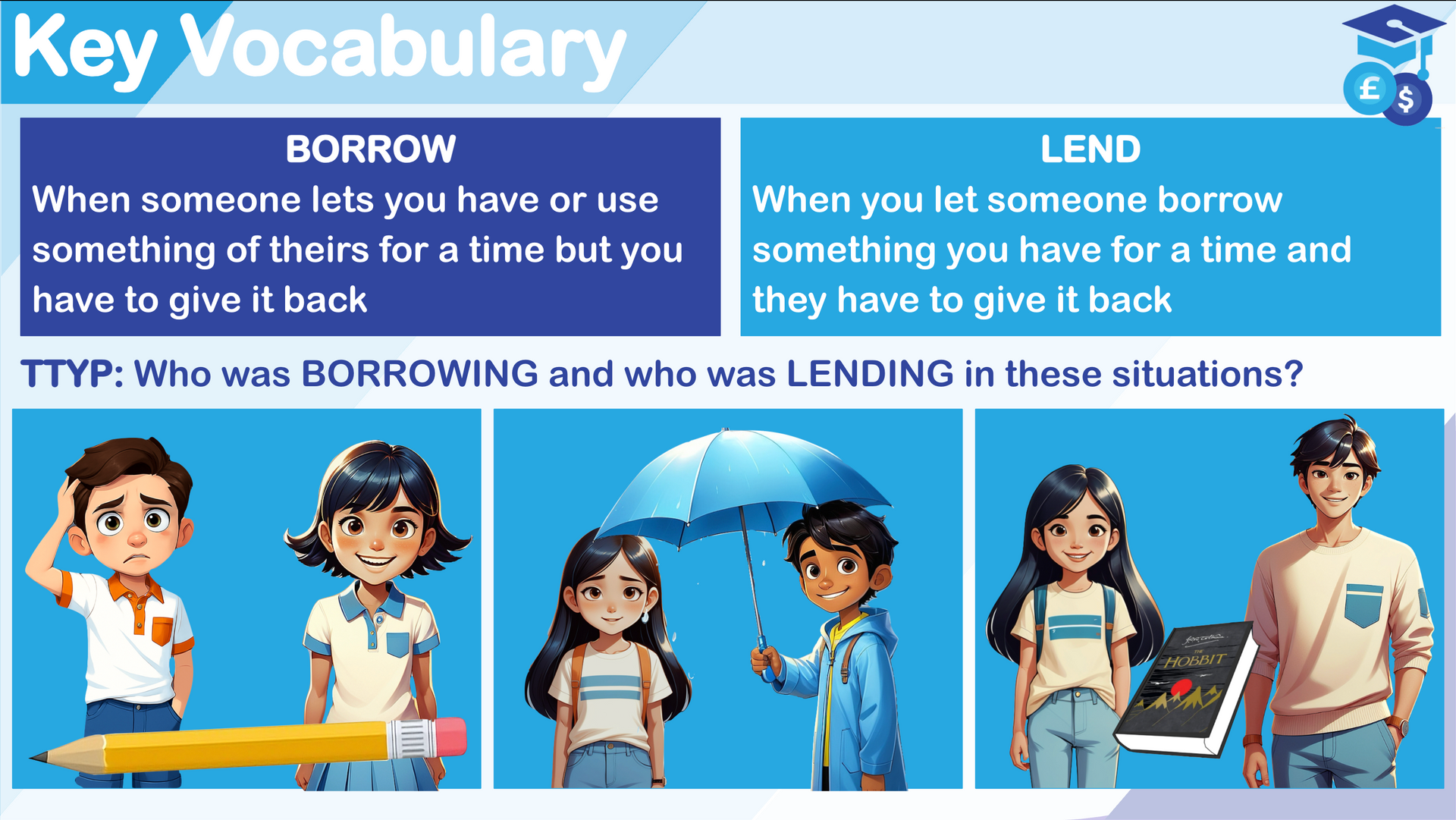

- How borrowing and lending work responsibly

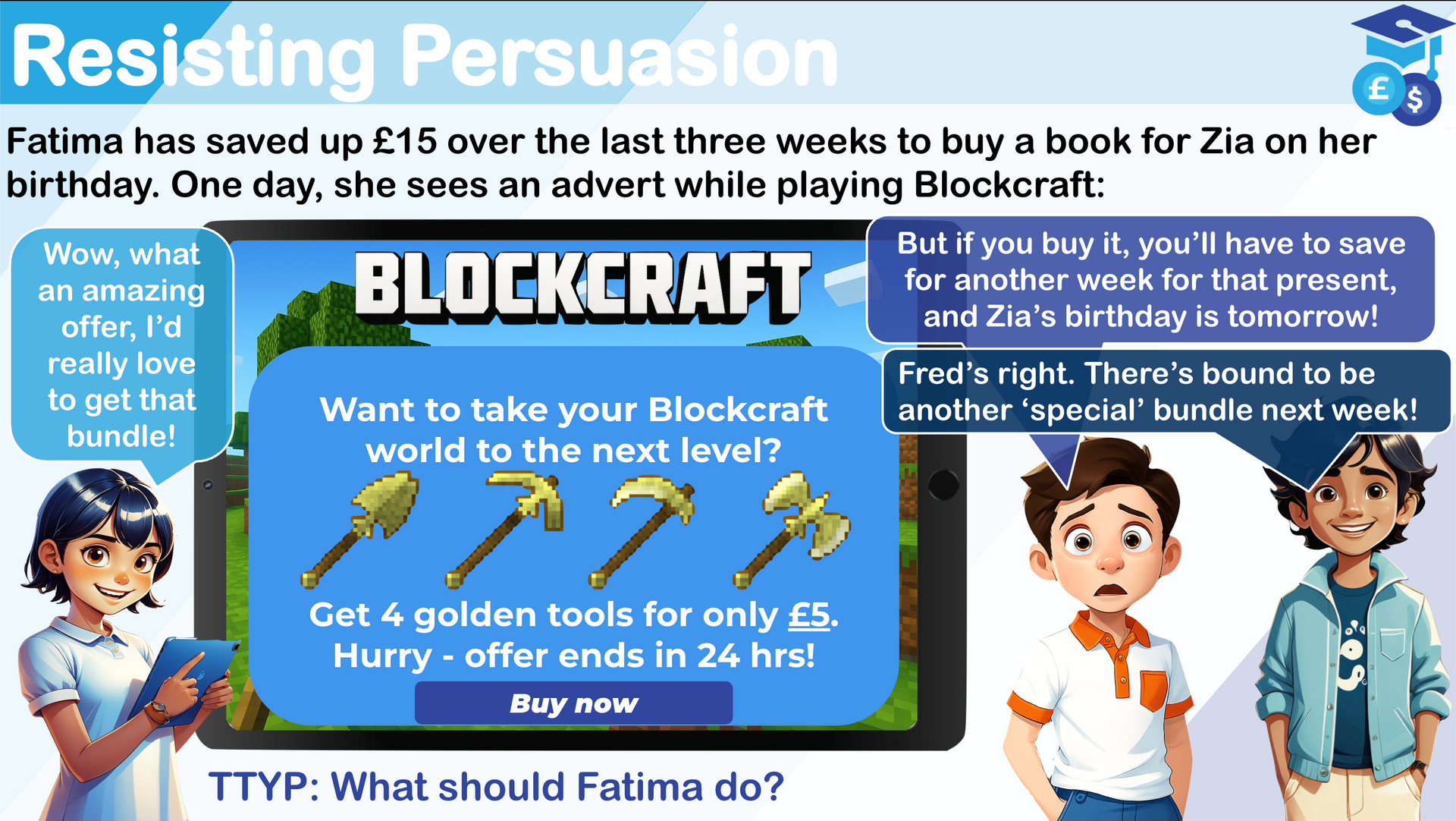

- How advertising influences spending decisions

- v How to ludae value for monev

- How to keep money and information safe

- How money links to emotions and fairness

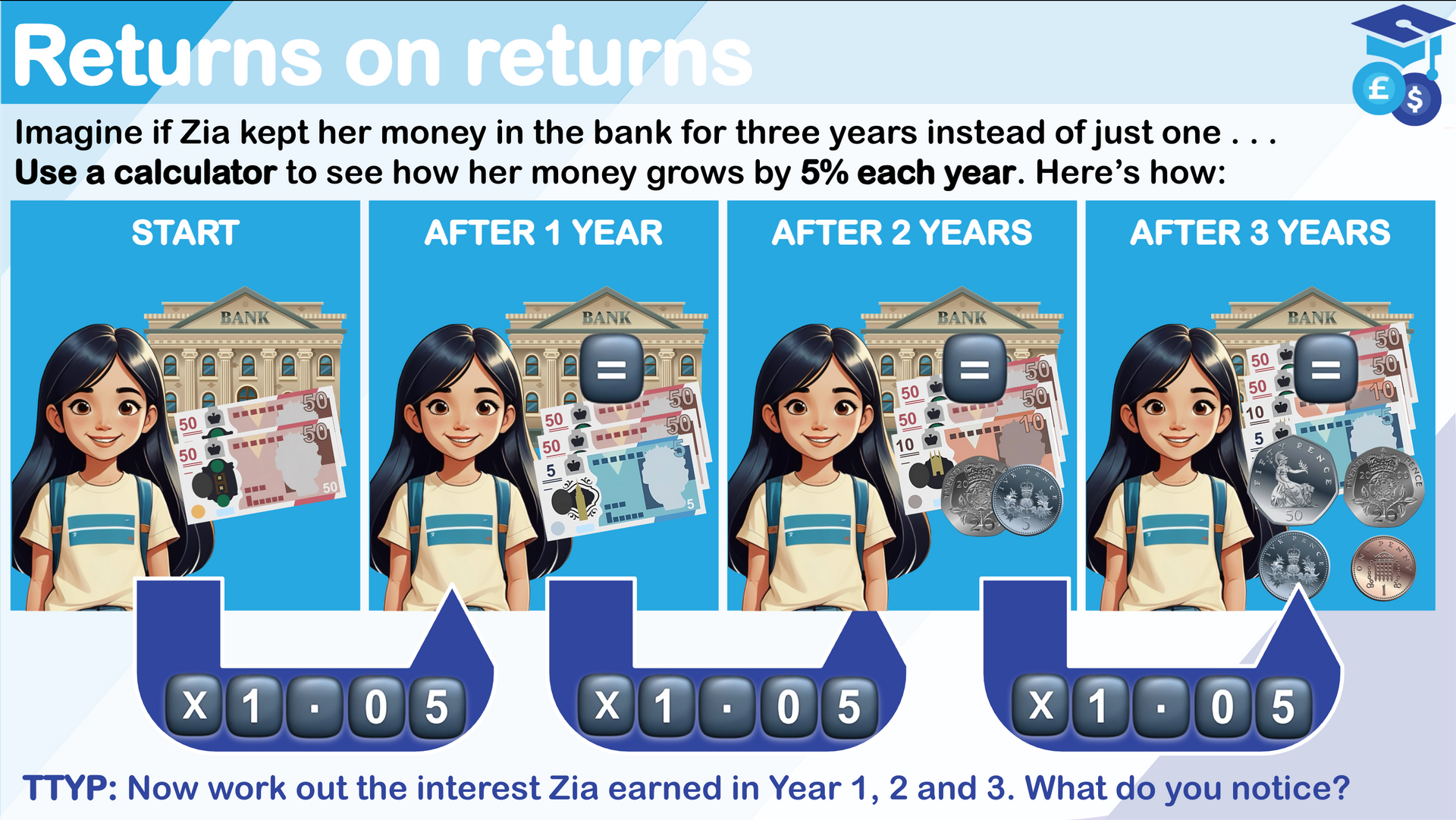

- What investing means and how it differs from saving

Rated EXCELLENT

Awarded the Young Enterprise Quality Mark for Financial Education

JuniorNomics

Ages 7 - 11

A child-friendly introduction to the world of economics

A cross-curricular programme introducing Y3-6 pupils to the 'big picture' of how money works in the world. From supply and demand to what the Bank of England does, JuniorNomics gives pupils a new

outlook on their learning in history, cluzenship and Psht. Watch as your pupils enthusiastically become junior economists!

Topics include:

- What economics is and why it matters V How economics helps us make choices

- How people lived and worked before money

- Why farming changed how societies organised

- How jobs, trade and specialisation developed Why money was invented and how it evolved v What makes money work well

- How prices, value and demand are formed Why some things are expensive or scarce The difference between money and credit V How banks and modern money systems work v How economic ideas shape today's world

Rated EXCELLENT

The Enterprise Lab

Ages 10 - 11

A one-half-term crash course in business and entrepreneurship

A 7-part module for Y6 on how to start and run a business. Through hands-on learning, guide your pupils to plan and produce products,

pitch for investment (With the help of some visiting parents!). and. make real profits at a school event, such as your summer fête!

Topics include:

- Assigning roles within the business

- How to shortlist business ideas

- How to decide on the best idea

- Undertaking market research

- Curating a brand image and logo

- Picking a price point

- Working out costs, breakeven points and profits An introduction to marketing

- Pitching for investment (to assembled SLT and/or parents!)

- Salesmanship tips!

Rated EXCELLENT

The Resources Bank

Ages 4 - 11

A library of cross-curricular resources to embed money skills throughout your school

An ever-growing library of standalone resources for almost every subject area, from money-themed maths investigations, to puzzles, to school assemblies. Embed money confidence across your school and further reduce teacher workload - a win-win!

Resources include:

- A design a new £100 note' art/design activity

- A Financial vocabulary tarsia puzzle

- Several money-themed maths investigations

- A new assembly for 'Talk Money Week' each year

- Themed resources for Christmas, Easter, Halloween, etc. v Classroom posters

- Display items

- Money-themed games

- Reading comprehensions to reinforce taught concepts

- AT LEAST ONE NEW RESOURCE ADDED EVERY WEEK!

Rated EXCELLENT

How Tykeoons Works

Comprehensive, Ready-to-Use Teaching Materials

Engaging Slide Decks

Designed for classroom or home learning, visually rich, large text and filled with engaging animations

Slots into existing timetable

No need to find extra time, simply use our suggestions to add these lessons to maths, PSHE and other subjects’ schemes of work.

Created by Teachers

Our programmes and lessons deploy the latest pedagogical thinking, each one filled with oracy opportunities and active learning ideas.

Beyond Worksheets

The independent task in every lesson is differentiated three ways and broken into smaller tasks for each success criterion.

UK Central Bank Financial Education Scheme

UK High Street Bank Financial Education Scheme

Tykeoons

Content about personal financial management

Developed by experienced school leaders

Content includes macroeconomics context

Expectation/pitch of lessons

Medium

Medium

High

Every lesson includes 3-way differentiated main tasks

Structure includes interleaving and retrieval practice

Entire module on creating a real profit-making business

Get Started for Free

Active Pilot – Free School Subscription

We believe every primary school pupil deserves access to high-quality financial and economic education. Our free Active Pilot subscription allows schools to meaningfully pilot Tykeoons by teaching real lessons with real pupils.

Your Active Pilot includes:

- Access to all MoneySmarts lessons for Y3 and Y5

- Access to all JuniorNomics lessons for Y3

- The full curriculum map for both programmes

- Up to a year’s access

- Continued access is automatically unlocked each term through active use of the platform

Schools typically use the Active Pilot to evaluate Tykeoons before rolling it out across further year groups.

UK Central Bank Financial Education Scheme

Content about personal financial management

Developed by experienced school leaders

Content includes macroeconomics context

Expectation/pitch of lessons

Medium

Every lesson includes 3-way differentiated main tasks

Structure includes interleaving and retrieval practice

Entire module on creating a real profit-making business

UK High Street Bank Financial Education Scheme

Content about personal financial management

Developed by experienced school leaders

Content includes macroeconomics context

Expectation/pitch of lessons

Medium

Every lesson includes 3-way differentiated main tasks

Structure includes interleaving and retrieval practice

Entire module on creating a real profit-making business

Tykeoons

Content about personal financial management

Developed by experienced school leaders

Content includes macroeconomics context

Expectation/pitch of lessons

High

Every lesson includes 3-way differentiated main tasks

Structure includes interleaving and retrieval practice

Entire module on creating a real profit-making business